- Bank

12 Months for 4.07% APY* !

Our Certificates of Deposit (CDs) offer a safe and reliable way to get guaranteed returns, helping to maximize your money.

- Borrow

Apply for a VISA Rewards Card Today!

Earn more and pay less with our Rewards Credit Card. Get 1.5% cash back on purchases and enjoy a low interest rate—nearly half the national average.

- Belong

Not a Member? Join Today!

As Howard County’s Community Credit Union, APL FCU is open to anyone who lives, works, attends school or regularly conducts business in the county.

- Resources

- Services

- Address Change

- Safe Deposit Boxes

- Foreign Currency

- Money Orders

- Wire Transfers

- Online Applications

- Additional Services

Financial Education with Banzai!

In-depth lessons and resources to help you dive into the financial topics you care most about.

-

Apply for a VISA Rewards Card Today!

Earn more and pay less with our Rewards Credit Card. Get 1.5% cash back on purchases and enjoy a low interest rate—nearly half the national average.

-

Apply for a VISA Rewards Card Today!

Earn more and pay less with our Rewards Credit Card. Get 1.5% cash back on purchases and enjoy a low interest rate—nearly half the national average.

-

- Accounts

- Access

- Account Services

12 Months for 4.07% APY* !

Our Certificates of Deposit (CDs) offer a safe and reliable way to get guaranteed returns, helping to maximize your money.

-

- Vehicle Loans

- Real Estate

- Credit Cards & Personal Loans

Apply for a VISA Rewards Card Today!

Earn more and pay less with our Rewards Credit Card. Get 1.5% cash back on purchases and enjoy a low interest rate—nearly half the national average.

-

- About Us

- Member Discounts

- Contact Us

Not a Member? Join Today!

As Howard County’s Community Credit Union, APL FCU is open to anyone who lives, works, attends school or regularly conducts business in the county.

-

- Services

- Learn

- News

Financial Education with Banzai!

In-depth lessons and resources to help you dive into the financial topics you care most about.

Routing Number #255077998

Digital Banking

Apply for a VISA Rewards Card Today!

Earn more and pay less with our Rewards Credit Card. Get 1.5% cash back on purchases and enjoy a low interest rate—nearly half the national average.

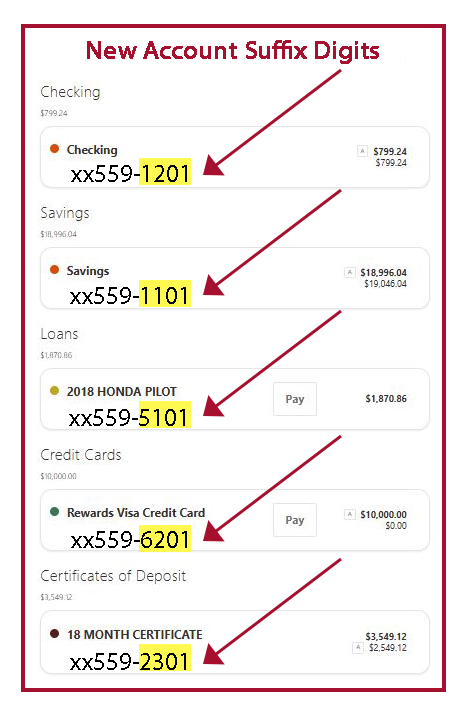

SYSTEM UPGRADE SERVICE COMPLETED:

|

APPLY | OPEN | JOIN

Existing Members

If you are currently an APL FCU member, please sign into Digital Banking to open new accounts and/or apply for a loan.

How will this upgrade affect my account access?

How will this upgrade affect my account access?